Overview

Netflix's (NFLX) stock has been on a meteoric rise in recent months, hitting all-time highs after the company reported stellar earnings that beat analyst expectations. The streaming giant's stock price has surged over 150% in the past year, making it one of the best-performing stocks in the S&P 500.

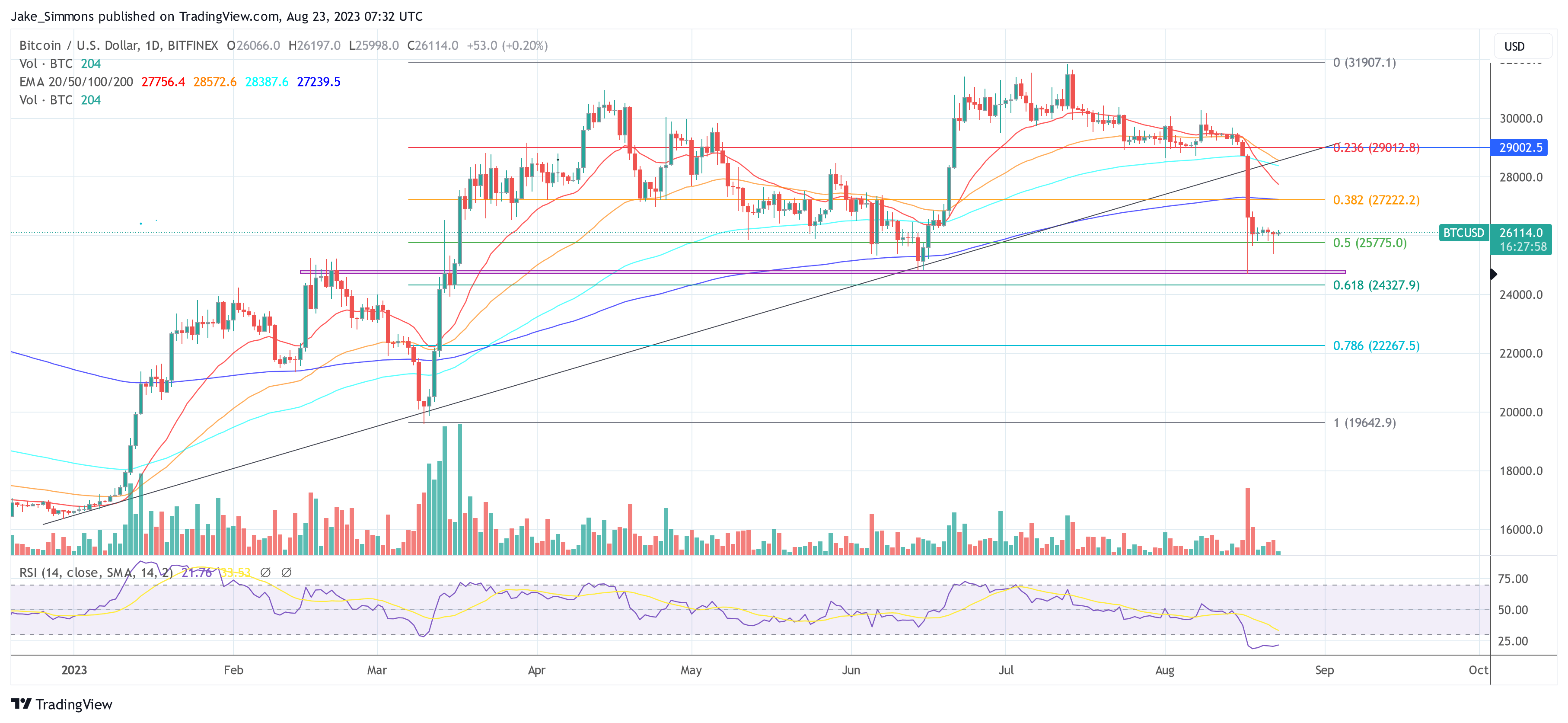

Key Price Levels to Watch

Following the recent rally, Netflix's stock is now trading at around $600 per share. Analysts are eyeing several key price levels that could provide support or resistance in the near term:

- Support: $550-$575

- Resistance: $625-$650

If Netflix's stock price falls below $550, it could indicate a potential downward trend. Conversely, if the stock rises above $650, it could suggest further upside potential.

Factors Driving the Surge

Several factors have contributed to Netflix's stock surge:

- Strong earnings: Netflix has consistently exceeded revenue and earnings expectations, demonstrating its dominance in the streaming industry.

- Growing subscriber base: The company has continued to add subscribers at a rapid pace, reaching over 220 million paid memberships worldwide.

- Original content: Netflix has invested heavily in creating original content, which has been met with critical acclaim and high viewership.

- Market dominance: Netflix is the largest streaming service in the world, with a significant lead over its competitors.

Analyst Perspectives

Analysts have varying opinions on Netflix's stock outlook:

- Bullish: Some analysts believe Netflix's growth potential is still significant, and the stock has room to run further.

- Neutral: Others believe the stock is fairly valued at current levels and may experience some consolidation.

- Bearish: A few analysts express concern about the company's high valuation and competition from emerging streaming services.

Risks to Consider

While Netflix's stock has performed exceptionally well, there are certain risks to consider:

- Competition: Netflix faces increasing competition from other streaming services, including Disney+, Hulu, and Amazon Prime Video.

- Content costs: The company spends billions of dollars on content creation, which could impact its profitability.

- Regulation: The streaming industry is subject to regulatory changes, which could affect Netflix's business model.

Conclusion

Netflix's surging stock reflects the company's strong earnings, growing subscriber base, and dominance in the streaming industry. While the stock has performed exceptionally well, investors should consider the key price levels to watch and be aware of the potential risks involved. Analysts have varying perspectives on Netflix's stock outlook, ranging from bullish to bearish. Ultimately, investors should conduct thorough research and consider their own investment goals before making any investment decisions.